President Biden’s proposed tax increases have many Americans wondering what the tax burden will be on their financial picture. Tax-advantaged strategies can help, and charitable giving is one of the most attractive. When tax rates increase, the out-of-pocket cost of making a charitable gift declines.

Should you wait until after tax rates rise to make charitable gifts? Not necessarily. It depends on the nature of the donation you’d like to make.

Cash Contributions and Gifts of Stock

In 2020, the CARES Act offered incentives for cash contributions to a public charity, to deduct up to 100% of adjusted gross income (AGI). This was extended through 2021, but in 2022 it will drop back down to 60% of AGI.

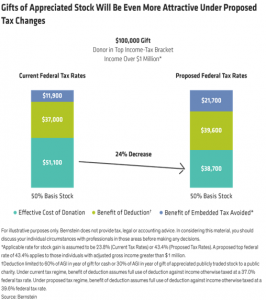

Another option is donating stock. Gifts of appreciated publicly traded stock not only provide a charitable income tax deduction for the value of the donation, but they also allow you to avoid taxes on the gain in the stock. After tax rates rise, the cost of making such a donation becomes even more compelling (see display).

Lower your tax burden with a gift of appreciated stock.

Philanthropic Opportunities

We can help you ease your tax burden this year, while deepening your support of our vital mission. Founded in 1998, the Northern New Jersey Community Foundation (NNJCF) is an IRS certified public charity. The NNJCF continues to serve the community by offering a comprehensive menu of philanthropic opportunities. As a regional resource, our mission focuses primarily on education, public health, civic engagement, arts, philanthropy, and the environment.

The NNJCF provides donors with flexible, efficient, and tax-effective ways to ensure their charitable giving has maximum impact through donor-advised funds, tax-saving annuities, trust options, and other forms of giving. Contributions to the Foundation are eligible for tax deductions, as permissible by law.

If you have questions about making a gift to the Northern New Jersey Community Foundation, please contact Associate Director Danielle De Laurentis at nnjcf@nnjcf.org or call 201-568-5608.